Melbourne Mortgage Broker Mentor – The home loan discharge process must be improved!

The mortgage and finance broking industry’s peak association has made six recommendations to improve the home loan discharge process in a new whitepaper released today. Among the recommendations included in the whitepaper, titled ‘Towards a faster, smoother home loan...

Melbourne Mortgage Broker Mentor – Empower Mentor Program

Mentoring is about helping people find their strengths, and in the process, we as mentors find new strengths in ourselves. No amount of book learning prepares people for the experience of becoming a mortgage broker. As a mentee, you have a certain mindset, but having...

Melbourne Mortgage Broker Mentor – Payroll tax ruling highlights legislation is flawed

Responding to the outcome of the Loan Market Group Pty Ltd vs. Chief Commissioner of State Revenue NSW payroll tax Supreme Court matter, the Mortgage & Finance Association of Australia (MFAA) said while it is disappointed by the ruling, the Court’s finding...

Mortgage Broker Mentor – Certificates of title go digital in Victoria

From 3 August 2024 all new Victorian certificates of title from the Register of land will be electronic. Electronic certificates of title (eCTs) were introduced in Victoria in 2009, and the phasing out of paper certificates is the next step for Land Use Victoria’s...

Mortgage Broker Mentor – Victoria introduces commercial and industrial property tax reform

Mortgage brokers operating in Australia will find this article very useful. From 1 July 2024, commercial or industrial property purchased in Victoria will be subject to a new property tax system. For commercial and industrial property transactions with both a contract...

Melbourne Mortgage Broker Mentor – Competition, not war when it comes to mortgage brokers

There has been a rush of headlines over recent weeks about banks being 'at war' with mortgage brokers. These headlines are misguided. They also ignore the most important player in this 'war': Australian borrowers. However, if some of the larger lenders are seeking to...

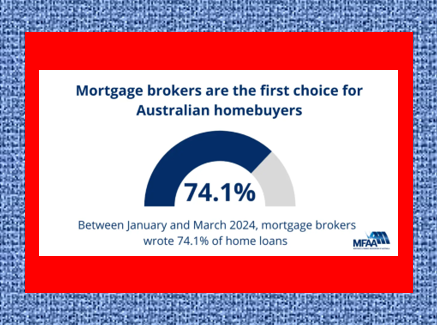

Melbourne Mortgage Broker Mentor – Mortgage brokers remain the first choice for homebuyers

Australian homebuyers are turning to mortgage brokers in record numbers, according to the latest data released by the Mortgage & Finance Association of Australia (MFAA). Between January and March 2024, 74.1% of all new home loans were written by mortgage brokers....

Mortgage Broker Mentor – New Reference Checking Legislation

The passing of legislation allowing for a comprehensive reference checking regime for the mortgage and finance broking industry has been welcomed by the Mortgage & Finance Association of Australia. The Treasury Laws Amendment (Modernising Business Communications...

Mortgage Broker Mentor – The value of building a good relationship with your BDMs

Building a good relationship with your lender's, aggregator’s, supplier's or Association's BDM (business development manager) can benefit your business in more ways than some brokers necessarily appreciate, says Shirley Ferris, principal loan writer and mortgage...

Mortgage Broker Mentor – E-signatures on statutory declarations become permanent

Temporary measures introduced during the COVID-19 pandemic allowing the electronic execution of statutory declarations have become permanent for documents executed under Federal legislation. This means mortgage and finance brokers can continue to execute statutory...